Well my recent articles about Reading's most moved street in the last 3 years and the Monopoly board article (the one where I listed the most valuable streets) caused quite a lot of interest locally, so I decided to see what else I could find out about the RG2 postcode area, and I have been able find out the biggest streets in the Reading (RG2) postcode area.

Don't worry, I will get back to some hard-hitting articles about the lack of new homes being built in Reading, the trials and tribulations of being a Reading buy-to-let landlord and the future of the Reading property market...yet in this article because of the previous positive comments, I wanted to give you what you, the Reading homeowners and Reading landlords asked about and wanted!

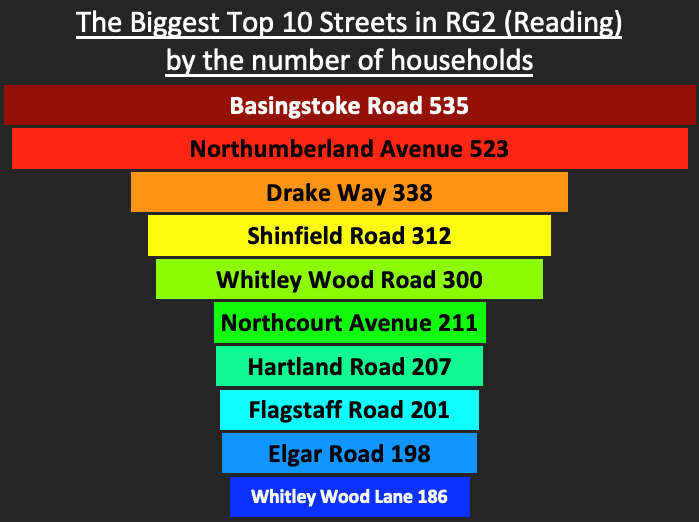

The biggest street in RG2, when it comes to the number of houses on it is Basingstoke Road, with 535 homes. In second place is Northumberland Avenue with 523 homes and in third is Drake Way with 338 homes.

Not surprisingly, the most valuable street of the top 20 biggest streets is Basingstoke Road at £153.6m with an average value of £287,000 per property.

The street with the greatest number of movers in the last 3 years is Drake Way, with having the highest saleability rate of 37.9%.

The full breakdown can be found in this chart below.

Street/Road | Number of Properties on the Street(s) | Total Value of Properties on the Street(s) | Average Value of Properties on the Street(s) | Number of Properties Sold on that street(s) in last 36 months | Saleability/Turn-over Rate in the last 3 years (# Houses divided by sales) |

Basingstoke Road | 535 | £153,586,000 | £287,000 | 38 | 7.1% |

Northumberland Avenue | 523 | £140,097,000 | £268,000 | 31 | 5.9% |

Drake Way | 338 | £77,704,000 | £230,000 | 128 | 37.9% |

Shinfield Road | 312 | £140,979,000 | £452,000 | 27 | 8.7% |

Whitley Wood Road | 300 | £87,213,000 | £291,000 | 32 | 10.7% |

Northcourt Avenue | 211 | £93,545,000 | £443,000 | 18 | 8.5% |

Hartland Road | 207 | £58,003,000 | £280,000 | 14 | 6.8% |

Flagstaff Road | 201 | £74,169,000 | £369,00 | 5 | 2.5% |

Elgar Road | 198 | £62,445,000 | £315,000 | 25 | 12.6% |

Whitley Wood Lane | 186 | £56,910,000 | £306,000 | 17 | 9.1% |

Staverton Road | 170 | £40,757,000 | £240,000 | 7 | 4.1% |

Cressingham Road | 164 | £60,026,000 | £366,000 | 11 | 6.7% |

Linden Road | 161 | £45,024,000 | £280,000 | 3 | 1.9% |

Windermere Road | 160 | £38,514,000 | £241,000 | 10 | 6.3% |

Blandford Road | 151 | £40,239,000 | £266,000 | 5 | 3.3% |

Ambrook Road | 148 | £41,904,000 | £283,000 | 7 | 4.7% |

Longships Way | 144 | £46,301,000 | £322,000 | 27 | 18.8% |

Kingsley Close | 131 | £32,134,000 | £245,000 | 2 | 1.5% |

Hexham Road | 131 | £27,949,000 | £213,000 | 5 | 3.8% |

Newcastle Road | 130 | £22,714,000 | £175,000 | 5 | 3.8% |

Yet, did you really think I wouldn’t get at all serious...

The basic rudiments of the Reading property market remain principally healthy in many parts of Reading, yet the existing political environment means that the vital element of confidence has been diminished slightly in certain parts, and that is triggering a minority of potential property purchasers and house-sellers to vacillate, yet with unemployment at an all-time low, a record number of people with a job, ultra-low interest rates and decent mortgage availability (with the Banks and Building Societies tending to drop mortgage rates instead of increasing them), those Reading first time buyers (and especially Reading buy-to-let landlords) who have adjourned their next house purchase because of perceived political uncertainty should be reminded that talking to many of my fellow Reading agents they have more homes on their books than at any time for the last three or four years, so there is a greater choice of Reading properties to call your next home/BTL investment with a potential of securing a great property deal in the next month or so.

Irrespective of what happens with Brexit, Reading people will still need a roof over their heads and as I have mentioned on a number of occasions, I have proved beyond doubt we aren’t building enough homes both locally in Reading and nationally. If supply is limited and demand increases (as the population grows and we get older), prices in the medium to long term can only go in one direction. Upwards!

So, whatever happens with BoJo and Brexit - why wait, because once we get over that hurdle, there will just be another hurdle and another hurdle and by which time - we will be in 2029 and you would have missed the boat. We survived the Global Financial Crash, 3-day week in 1970s', hyperinflation etc etc ... yet the choice is yours.